Debt-Free Capital

For Life & Health Agents

As a capital resource tailored specifically to independent agents and agencies, we convert future insurance commission streams into a debt-free, lump-sum payment.

-

We're Unique: Lenders simply do not understand insurance commissions like we do, which allows us to place the most fair and equitable value on your block of commissions

-

We're Punctual: We will value your commission streams both punctually and accurately. We know that when it comes to renewal commissions time is money

-

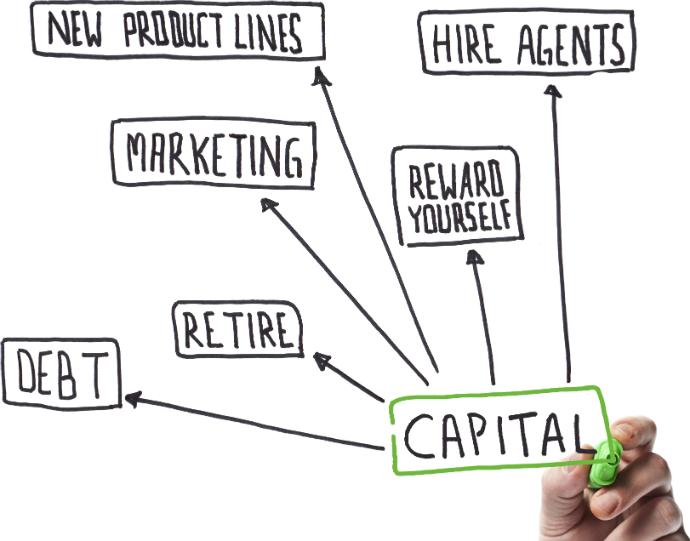

Use your capital however you wish, no strings attached...

Our working philosophy:

"Funding for agents, by agents"

ACCESS Capital Group was founded by people just like you - insurance agents. We understand the challenges that agents face on a daily basis, especially in acquiring capital.

With this mindset, we have developed a streamlined process to get you the capital that you need - free of the burdens associated with other "traditional" capital resources.

Simple Four-Step Process

- 12-Months of commission statements

- Original Carrier Contract(s)

- Commission Schedule(s)

- Signed Confidentiality Agreement

Why Choose Us?

We focus on the life and health insurance markets, purchasing commissions generated by (but not limited to) the following product lines:

- Long-Term Care Insurance

- Medicare Supplement Insurance

- Critical Illness & Cancer Coverage

- Disability Income

- Final Expense Life

- Whole Life Insurance

- Supplemental Health Plans

- Accident Plans

ACCESS Capital Group, headquartered in Omaha, Nebraska, was founded in 2007 by insurance professionals with over 30 years of combined experience in the insurance industry.

Our founders recognized the difficulties that exist for independent agents in acquiring capital. Through their past experiences of trying to acquire capital through traditional lenders (i.e., banks, credit unions, etc.) they became aware that most financial institutions did not appreciate or understand the value of commission streams from a collateral perspective.

Add to that the fact that when they were able to acquire capital through these traditional mechanisms, the interest rates were so high that it didn't make any sense to pursue them from a business standpoint.

Voila, ACCESS Capital Group was born. They created this financial services company specifically tailored for insurance agents and agencies. Since inception we have provided thousands of agents with millions of dollars in capital - the entire time leaning on our core fundamentals of honesty, integrity and ethical business practices.

Now is the time to Access your Capital

We'll take a look at your commission streams -- right now -- for free!

Why ACCESS Capital Group?

We are a company built by people just like you - insurance agents. We understand the challenges that agents deal with on a daily basis. We especially understand the obstacles agents face in acquiring capital. Our team has developed a streamlined process that provides the most accurate market value of your book of business. We will guide you through the process and make it easy to access the capital you need.

What types of renewal commissions do you purchase?

Our focus is on the ever-expanding Senior Life and Health insurance market. Specifically, we are seeking the following product lines: Long-term Care Insurance, Medicare Supplement Insurance, Critical Illness and Cancer Coverage, Disability Income, Final Expense Life, Whole Life Insurance, Supplemental Health Plans, and Accident Plans. You can always call to discuss your specific book of business.

How long does it take to value my business and make an offer?

There are four primary steps necessary to complete a valuation and close a transaction: Step 1: We gather the necessary commission data, Step 2: We provide a customized valuation, Step 3: Your acceptance of the offer and our completion of required paperwork, Step 4: We close the transaction and you receive your capital. Each step takes a few days to complete. Typically the entire process takes between 2-4 weeks.

Is the capital provided a loan?

The capital we provide is not a loan. There are no payments due and there is no interest incurred. As part of our customized valuation, we do offer a re-purchase option which provides the ability to re-purchase your commissions at specified future points in time.

Can I still have contact with my clients?

Absolutely! In fact, we encourage it. Your clients will not see any change in their relationship with you or their insurance company. As part of the transaction, ACCESS Capital Group will continually monitor the persistency of your business and ensure that is performs as anticipated.

Do you offer a referral program?

We have an excellent Referral Partner program that provides you the opportunity to earn additional income with very little effort! Please visit our "Refer" page for more information.

Now is the time to Access your Capital

We'll take a look at your commission streams -- right now -- for free!